MAHINDRA FORGINGS LTD

Mahindra Forgings Ltd is among the top global forging companies with multiple manufacturing facilities in India, Germany and UK. The company produces most of the forging components for cars and commercial vehicles. It generates close to 80% of its revenues from its international operations, which primarily caters to the European region.

Mahindra Forgings operates through Stokes Forgings in United Kingdom, having three manufacturing facilities. The company caters to the German market through Jeco (4 plants) and Schoneweiss (3 plants). These facilities provide a diversified and complementary portfolio for its customers. Daimler Chrysler and MAN are Mahindra

Forgings‘ top customers.

Problem

Mahindra Forgings over 2/3 rd of its revenues from its international operations. The global slowdown post the Lehman crisis affected the demand for automobiles globally. This slowdown had a cascading effect on auto ancillary manufactures including Mahindra Forgings. Sales slumped from r 2,318 crore in 2008 to 2,242.4 crore in 2009 and to r 1,327 crore for in 2010.

Mahindra Forgings consolidated EBITA declined from r 195.2 crore in 2008 to r 144 crore in 2009. The EBIDTA for 2010 showed a loss of r8.8 crore as a result of decline in sales.

Signs of A Turnaround

If we look at last two quarters number we see a strong pickup in sales after staying flat in the range of R 300-325 crore in the lean period.

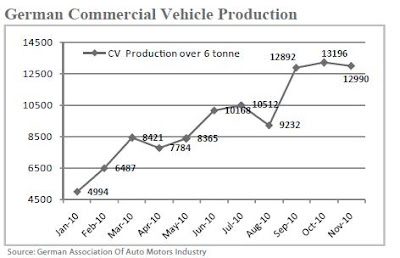

Since the company has 7 plants in Germany, we analyzed the German production data for Commercial Vehicles over 6 tonne, where Mahindra Forgings is considered a leading supplier. We have seen that the demand has remained firm over the last 3 months in the range of 12,000-13,000 vehicles as shown. If the demand continues to remain firm, we would see it trickling down to auto manufacturers like MFL. We expect the company to post higher consolidated sales for Q3 FY11 and for FY 2012 on account of improved global demand.

Mahindra Forgings successfully reduced its cost . Employee cost reduced form r593 crore in 2009 to r363 crore in 2010. Other than , it seems company has managed to control as well, as seen through quarterly numbers . The company has even close a plant in UK as a part of restructuring .

With improved global sales coupled with reduction in costs, the company is addressing important issues. Mahindra Forgings is available at an Enterprise Value of r1,345 crore. E/V Sales stood at 0.6 for 2009,1.01 for 2010 and 0.78 for H1FY11 as against Bharat Forge’s EV/ Sales of 3.2 for 2010.

MFL’s acquisition of Jeco was at EV of around r800 crore . At current price of r82 the company’s EV is close to r1,300 crore, with increased possibility of a turnaround. Mahindra Forgings appears to be offering value at current levels

Thanks & Regards

Dev Purohit

Thanx Dev,this post is quiet informative

ReplyDeleteThis company will really play a major role beacause of the project undergoing the statement that has been made in parivartan the in house magazine of mahindra by vineet & deepak dheer md of mahindra forgings

ReplyDeleteThis information is very useful. Thanks for posting this.

ReplyDelete